By Mark Sokolove, Executive Vice President of Tigercomm

By Mark Sokolove, Executive Vice President of Tigercomm

UPDATE 5/19/14: Paul De Martini adds the following update to this article, in anticipation of his speaking appearance at the National Town Meeting on Demand Response and Smart Grid in Washington, DC.

Public policy is catching-up to the technology and services innovation cycles and beginning to address the gaps on "how" to scale green and smart grids. This is what EPRI's Integrated Grid and several states (e.g., California, Hawaii, and New York) are beginning to tackle. Policy over the past decade was largely focused on setting stretch goals irrespective of how to implement those goals. That was ok, until we reach an inflection point in customer adoption in which incremental change has to give way to transformative changes in how the grid is planned, designed, operated and distributed resources are integrated through differentiated services. Also, the article focused on 2020, but given the policy and business decision cycles and implementation time cycles, we to aim toward 2030. This becomes more challenging as innovation is accelerating and we can expect to see very disruptive energy and consumer technologies over the next 10+ years as we have over the past ten (e.g., Facebook in 2004, Twitter 2006, iPhone in 2007, Instagram 2010, Nest 2011, etc.). This means we need to be transforming the distribution grid into a highly scalable open platform for customers' distributed energy resources and microgrid evolution if the audacious goals of the past decade are to be achieved. It is important to consider that an investment in the electrical grid today is effectively a 15-30 year bet on the future of innovation. As Bill Gates said, "We always overestimate the change that will occur in the next two years and underestimate the change that will occur in the next ten."

Back in May, I had the opportunity to catch a presentation by Paul De Martini of the Newport Consulting Group and the California Institute of Technology, at a CleanTech OC smart grid event in Irvine, California. De Martini previously served as Chief Technology Officer for Cisco’s global Energy Networks Group, and also as vice president of Advanced Technology at Southern California Edison, where he led their $2 billion smart grid strategy, policy, and research and deployment activity. Given that background, he clearly is an expert in this area and knows what he's talking about.

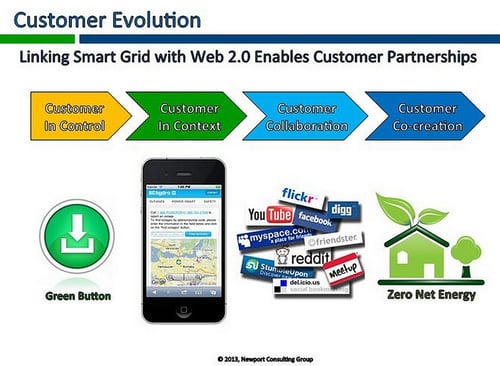

A few weeks after the conference, I caught up with De Martini by phone for a brief Q&A (see below) on his perspective about the smart grid market in the U.S., as well as his vision for marrying Web 2.0 with the smart grid/smart meters. We are posting this interview hours before De Martini speaks this afternoon at the National Town Meeting on Demand Response and Smart Grid in Washington, DC.

MS: As you've pointed out, we've only scratched the surface of what "social business" will look like for utilities and other energy providers operating as part of a smart grid, How do you see this playing out over the next few years, and how much of it depends on effectively making the business case for smart grid?

PD: The smart grid encompasses many different elements, including a wide range of technologies, grid modernization, etc. There's no single business case, but there are individual components that make a lot of sense to move forward on.

It's clear that being customer-facing is increasingly part of the equation of how we achieve sustainable objectives. This includes working towards a deeper level of engagement with customers, as well as tying into social business as a way to approach that engagement. This will involve much more sophisticated communications than even in the recent past, when billing inserts and web portals were seen as cutting edge.

The reality is that the concept of engaging in a regular dialogue with customers is relatively new for the utility industry. Today, however, the customer wants and expects communications anytime and anywhere. This means we have to engage on social media, and increasingly on mobile devices, which customers have shifted to fairly significantly over the past few years. Given this shift by their customers, utilities have to follow suit.

Today, we're really starting to see some collaboration between utilities and their customers. A few fairly recent examples in terms of collaboration include:

- San Diego Gas and Electric – Increased information sharing, more utility-to-customer communication, ways the customer can save money.

- BC Hydro (Vancouver, BC) - "Power Pointers" on how residences and businesses can save money and energy.

- Info/Intel – quite a few utilities have been leveraging technology over the past few years, such as Opower and Tendril.

One question is how all this ties into social business. Most of the interaction with customers, aside from technical needs, will be done through social media. It will probably be a combination of a controlled system layer (machine to machine) and the piece on top, social media.

MS: We recently had smart grid communications expert Judith Schwartz in to speak to our Scaling Green Communicating Energy lecture series. Among other things, Schwartz argued that although the smart grid can help any business' bottom line, specific benefits and optimal utilization of the smart grid will vary by the type of business (e.g., a warehouse storing temperature insensitive goods doesn't care if the temperature goes up on a hot afternoon, but a movie theater does). Do you agree with this perspective?

PD: I think it's important, but a distinction needs to be made between discretionary loads and non-discretionary loads. For instance, operation of producing or consuming devices (e.g, chillers, AC units, building automation systems, CHP) has degrees of flexibility. Some of this flexibility can be significant - up to 20% load reduction or dispatchable energy.

One of the challenges for the industry is how do we tap into this, including in residences. Is there a value for the customer that really wouldn’t impact operations, at the same time providing a mutual benefit to the grid/market? At the most fundamental level, it's about this concept of transactive energy, the ability to tap into a potential energy resource using market-based incentives, while of course taking grid reliability constraints into account. How we get there will be via a set of technologies and market design. This will take some time, and demonstration projects that have been underway for a while are looking at how best to do it.

One important question is how do we translate the value from the grid market side for customers, while not impacting operations, comfort or convenience?

MS: In an interview you did with Greentech Media in 2012, you argued that "There’s a conservatism about signing up to realize the benefits [of new technology]," and that "Transforming from a vertical to a horizontal approach is challenging.” What do you believe the best approaches are for dealing with these challenges?

PD: This is a major issue and goes to the previous question, understanding the smart grid's value and being able to monetize that value. Some stumbles with smart grid investments occur because there's no clear value proposition for all parties involved. Obviously, you need a buyer and seller, that's basic economics. The deal can look great, but both parties need to get something out of it when all the costs are factored in. Also, you need to look at the impact on the business, the actual cost of technology on their side, measurement, etc. Sometimes, the net result is not all that great.

The focus should be on demonstrating the smart grid's value more clearly. You can’t just look from the grid side, but have to look at the customer perspective as well. This includes coming up with really clear, transparent ways to monetize value for either side. The customer wants to see real and tangible results, savings on their energy bill or a revenue stream. That sounds simple, but in reality it's much more complicated.

MS: How important are state and federal policy decisions in spurring - or holding back - the development of the smart grid in the United States? What policies do you believe would have - or have had - the most positive impact?

PD: Most of the policies we've seen in recent years have been extremely supportive of a smarter, effective grid. For instance, we've had the Energy Policy Act in 2005, also FERC rulings which have been generally supportive for customer resources to participate in grid operations and wholesale markets. We've seen the same thing in quite a few states, particularly California. Of course, the devil is in the details. Technology needs to catch up to policy, which is happening rapidly, but lags in some areas (e.g., control systems).

One policy area that needs more work and refinement is market access rules. Currently, these rules are still based around technological capabilities from 10 years ago. This involves some utilities, some PUCs, independent system providers, NERC and reliability councils, organizations like that, all of which have rules that pertain to them one way or another. This paradigm shift is just starting.

MS: Can you elaborate a bit on how the convergence of four key networks - social, cyber, electric and energy market - is helping to drive the growth of the smart grid?

PD: This is a good question for which I don’t have a simple answer. The pace of change in social media is moving significantly faster, in terms of innovation cycles, than the other 3 quadrants (cyber, electric, and energy market). Social media's innovation cycle tends to be on the order of every 6 months; cyber every 2-3 years; energy markets every 5 years; and the electricity grid every decade or two.

So, when we talk about integration by 2020, we need to look at the very deeply integrated components, how to best architect them. Essentially, the gears are connected, one spinning really fast and others slower, so the challenge is to integrate without burning out. This poses both challenges we'll need to meet and opportunities we stand to benefit from.